Tax Benefits for Donors in Japan

Tax Benefits for Donors in Japan

Donations to Nagoya University are eligible for tax benefits.

According to the tax reform in 2018, when individuals donate property such as stocks and land, by procedures Relocation income tax is exempt.

Please contact Nagoya University Development Office.

Individual Donors

Income Tax (Income Deductions)

Donations in excess of 2,000 yen per year qualify as income deductions for tax purposes.

Donation Amount

-¥2,000

=Income Deduction Amount

Resident tax

For the donors who live in prefectures or municipalities which designate Nagoya University as a “corporation or other entity eligible for a donation tax credit,” their individual inhabitant tax for the following year will be reduced, in addition to the income deduction (or tax credit ). Please check the current status of ordinance designation in Aichi Prefecture for information on which local governments are subject to this deduction.

( Donation Amount - ¥2,000 )

×4~10%*

=Amount of Inhabitant Tax Deduction

(The maximum amount of donations subject to the deduction is 30% of gross income for the year.)

* Donations designated by prefectures: 4%;

donations designated by municipalities: 6%;

donations designated by both prefectures and municipalities: 10%.

Inheritance Tax

When donation is a bequest, the amount of the donation is exempted from the inheritance tax owed by inheritors.

Corporate Donors

The entire donated amount can be counted as deductible expenses.

Education Support Project

Let's support the scholarly ambitions of students who bear the weight of the next generation on their shoulders.

Education Support Project is intended for students who have difficulty continuing their studies for economic reasons, with the goal of providing needed assistance through the projects outlined below. These projects encourage talented students as well as their motivation to learn.

-

- 1Tuition Exemption Project

- Students are exempted from all or part of the cost of tuition, admission fees, and/or room and board. Other supports which reduce students' economic burden.

-

- 2Financial Aid Project

- Provides loans or grants to cover school expenses.

-

- 3Study Abroad Support Project

- Covers the costs related to study abroad for students when such study is deemed necessary for purposes of education or research

-

- 4TA and RA* Project

- Covers the expenses required to employ students in educational or research positions, mainly to help students improve their own talents.

*TA: Teaching Assistant; RA: Research Assistant

Research Support Project

Let's support the young researchers and doctoral students who have a hard time finding their permanent academic jobs

This project is intended for young researchers and doctoral students who have a hard time finding their permanent academic jobs, with the goal of providing financial support needed to improve their skills as a researcher.

-

- 1When selected as a member for a research project

- When selected as a member for a research project and conducting a research as an independent researcher, this program covers the research expenditures.

-

- 2Publish research papers and participate in academic conferences

- This program offers financial aid needed when publishing research papers and participating academic conferences.

-

- 3Interaction with researchers from different areas

- In order to foster skills and qualities as a researcher, this program promotes interaction with researchers (including those who have work experiences) from various different areas.

(*not applicable for undergraduate students)

Tax benefits for the Education Support Project and the Research Support Project.

Due to the 2016 tax reform, individuals who make a donation to any eligible student supporting program that is implemented by a national university or the like are now able to choose "tax credit" in addition to "income deduction" an existing tax benefit scheme.

The Study Support Programs implemented by Nagoya University Foundation are eligible for the "tax credit" Donors can choose either "income deduction" or "tax credit" when filing a final tax return.

*At first, this was eligible only for the Education Support Project. However, the Research Support Project was added in 2020.

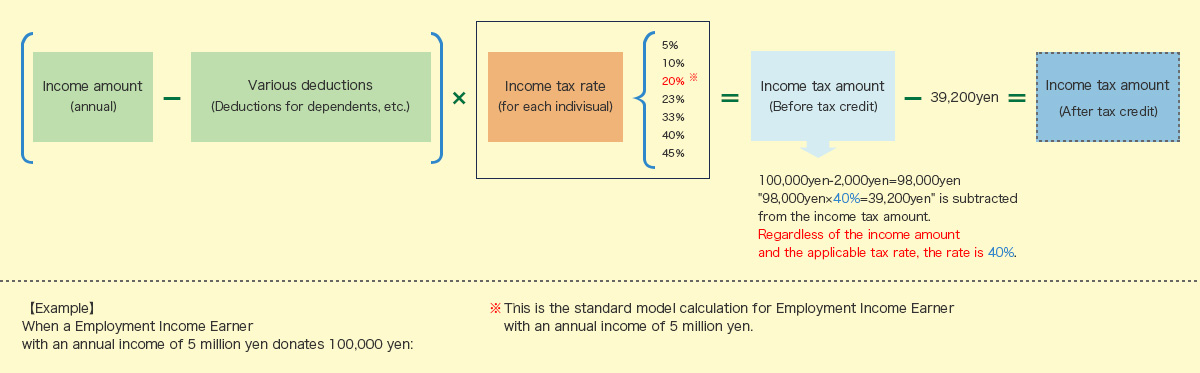

Tax credit

A tax benefit scheme that directly subtracts a certain percentage of the amount donated from the donor's income tax amount, regardless of the income tax rate applicable to the donor. This scheme allows many individuals to gain more tax benefit than the income deduction.

When filing a tax return, a donation receipt and a certificate of tax deductible donation (copy) need to be submitted.

A copy of the certificate for tax deductible donation will be sent to the donor together with the donation receipt.

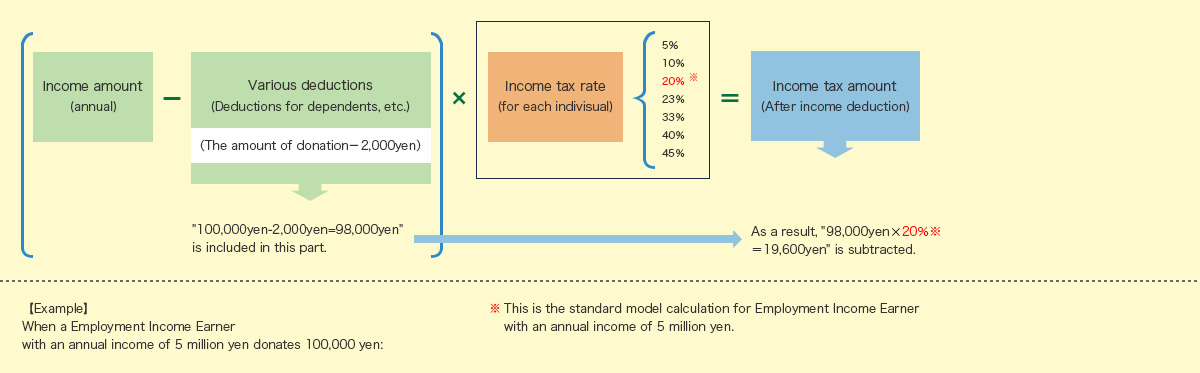

Income deduction

The amount obtained by multiplying the donation amount by the tax rate determined based on the donor's income will be subtracted from the income tax amount. If the amount of the donation is relatively large considering the donor's income amount, or if the income tax rate applicable to the donor is high, it may be advantageous to choose this option.

When filing a tax return, donation receipts need to be submitted. (A certificate of tax deductible donation (copy) is not required.)

* The above indicated case is just an example. The actual deductible amount will fluctuate depending on the types of income and other income deductions.